Fees & finance

Home buying made easy

Buying a residential park home

Discover everything you need to know about buying a residential park home — from financial considerations and understanding the key differences between residential and holiday park homes, to our simple 3-step buying guide and part-exchange options.

Understanding costs

Stamp Duty

You do not have to pay stamp duty on a residential park home. Stamp duty is typically only applicable to traditional property transactions involving land or bricks-and-mortar homes, not to park homes.

Council Tax

Typically, park homes will have a low council tax band - expected Band B.

Utility Bills

There will be the usual utility bills to factor in, like electricity, water, and gas, as well as other bills to remember such as insurance, and potential maintenance or repair costs.

Site Fees

Site fees are mainly charged for leasing the land where your home is situated. Although you will fully own your home, the park operator retains ownership of the land, so site fees will still be applicable. The site fee for 2025/2026 is £304.70 per calendar month. The pricing is reviewed annually, and Shorefield has the authority to adjust it in line with the Consumer Price Index (CPI).

Solicitor's Fees

Our dedicated team of experts are here to support you throughout the entire process and address any questions you may have. While appointing a solicitor is not necessary, should you prefer legal guidance or have concerns that fall outside our expertise, we recommend seeking professional legal advice.

Reselling

You can sell your park home through a traditional estate agent, or park home specialist, as you would any other home. Please note it is currently government legislation that a 10% commission of the sale price is payable to the Park Owner upon completion.

Mortgages

Traditional mortgages are not available for residential park homes. This is due to the classification of these homes and the nature of the tenure. Residential park homes are often considered mobile homes or caravans and are situated on land that is leased rather than owned outright, which does not meet the criteria for standard mortgage lending.

Instead of traditional mortgages, you might explore the following alternative financing options:

Specialist Park Home Loans: Some lenders specialise in loans specifically designed for park home. These loans may have different terms and conditions compared to traditional mortgages.

Personal Loans: Depending on your creditworthiness, you might qualify for an unsecured personal loan. These loans can be used for a variety of purposes, including purchasing a park home.

Equity Release: If you already own a property with substantial equity, you might consider an equity release scheme to fund the purchase of a park home.

Savings and Investments: Using personal savings or investments to fund the purchase can be a viable option if you have sufficient funds available.

(Remember! It's important to research and understand the terms and conditions of any financing option you consider, or consulting with a financial advisor can also be beneficial).

Residential vs. Holiday Park Homes

Watch this quick guide from the British Holiday & Home Parks Association to understand the key legal and financial differences before you decide.

Step-by-Step Guide

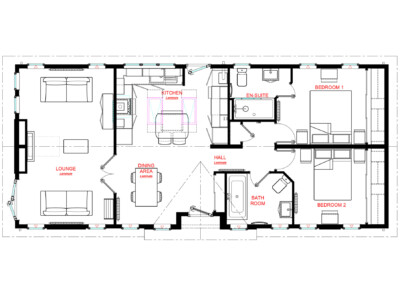

Your 3-step guide to buying a residential park home

Find your perfect location

Our residential park in Wimborne, Dorset, offers the ideal location in the country to settle down permanently, and we have various park show homes available with 2 or 3 bedrooms to purchase today. We can also work alongside you to design a bespoke home for your needs.

Costs to consider

As with any residential park there are running costs that you will need to consider to be a resident at Merley Court. Costs like pitch fee, council tax, electricity, gas and water.

How can I purchase?

Normally, funds will come from a house sale. We can also help with this via our part exchange company. They can help take all of the hassle away from selling your house and will aim to get you market value or close to.

Part-exchange

Found your dream home, but struggling to sell your own? With part-exchange, we can help make your move a stress-free, seamless process.

Quick, easy and guaranteed

Part-exchange offers a simple and hassle-free way to sell your home, allowing you to move into your new Merley Court home with ease.

With a guaranteed sale and a fast completion process—often in as little as 28 days—you can transition to your new home with confidence.

Backed by industry accreditation and excellent customer reviews, this service ensures a smooth and reliable experience.

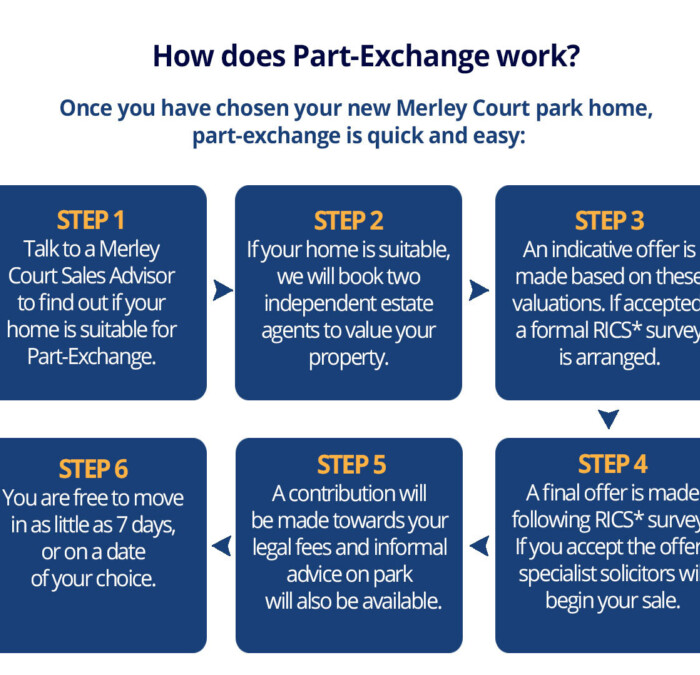

How does it work?

With our part-exchange service, moving house is quick, easy and guaranteed.

If you’ve never used part-exchange before, don’t worry - it’s a straightforward process designed to make moving as easy as possible - you won’t need to worry about finding a buyer, managing a chain, or dealing with unexpected delays.

Plus, if your buyer pulls out, a chain repair service will step in to keep your move on track.

See our step-by-step guide to how it works here, or talk to a member of our team at Merley Court today to see if your home is suitable. Don't let a slow sale hold you back!

Have a question?

Want to know more about part-exchange, or can't find what you're looking for?